According to the Ministry of Food and Drug Safety(MFDS), the market size for the medical device sector in South Korea has doubled since 2010. Ranked 9th in the world in 2018, Korea’s market reached approximately $6.2 billion in 2018 and imports from the US increased from 0.9 billion in 2010 to $1.8 billion in 2018

South Korea i s a country in East Asia, constituting the southern part of the Korean Peninsula, and sharing a land border with North Korea. 25 million people, around half of the country’s population of more than 51 million people, live in the Seoul Capital Area, the fifth-largest metropolitan area in the world.

South Korea is a developed country and is ranked as the seventh-highest country on the Human Development Index in Asia. Its economy ranks as the world’s tenth-largest by nominal GDP. Its citizens enjoy one of the world’s fastest Internet connection speeds and the most dense high-speed railway network. The country is the world’s fifth- largest expor ter and eighth- largest importer. South Korea was in 2017 the world’s 7th largest emitter of carbon emissions and the 5th largest emitter per capita. Since the 21st century, South Korea has been renowned for i ts globally influential pop culture, particularly in music ( K- p o p ), T V dramas and cinema, a phenomenon referred to as the Korean Wave.

South Koreans have access to a universal healthcare safety net, although a significant portion of healthcare is privately funded. In 2015, South Korea ranked first in the OECD for healthcare access. Satisfaction of healthcare has been consistently among the highest in the world – South Korea was rated as the second most efficient healthcare system by Bloomberg.

The quality of South Korean healthcare has been ranked as being among the world’s best. It had the OECD’s highest colorectal cancer survival rate at 72.8%, significantly ahead of Denmark’s 55.5% or the UK’s 54.5%. It ranked second in cervical cancer survival rate at 76 . 8 %, significantly ahead of Germany’s 64.5% or the US at 62.2%. Hemorrhagic stroke 30 day in-hospital mortality per 100 hospital discharges was the OECD’s third lowest at 13.7 deaths, which was almost half the amount as the US at 22.3 or France’s 24 deaths. For Ischemic stroke, it ranked second at 3.4 deaths, which was almost a third of Australia’s 9.4 or Canada’s 9.7 deaths. South Korean hospitals ranked 4th for MRI units per capita and 6th for CT scanners per capita in the OECD. It also had the OECD’s second largest number of hospital beds per 1000 people at 9.56 beds, which was over triple that of Sweden’s 2.71, Canada’s 2.75, the UK’s 2.95, or the US at 3.05 beds.

Healthcare in South Korea

South Korea’s public healthcare system is referred to as National Health Insurance (NHI). It is of extremely high quality and all residents living in Korea for a period longer than six months are required to register. When using the healthcare system in urban areas, it is common to find English speaking doctors and staff members.

The quality of Korean people’s lives has been increasingly improved in general due to the development of medical technology. The average life expectancy for males increased from 51.1 in the 1960s to 75.7 in 2006. The change in average life expectancy for females is even more startling, from 53.7 in the 1960s to 82.4 in 2006. In 2007, the crude birth rate was 10.1 and the crude death rate 5.0. Infant mortality is also decreasing gradually, from 61.0 per 1,000 live births in the 1960s to 5.3 per 1,000 in 2005. The total fertility rate is sharply decreasing, from 1.67 in 1985 to 1.13 in 2006.2. However, the increasing elderly population and decreasing birth rate are changing family structure in South Korea. The aging population is also becoming a social burden due to increasing medical expenses.

The quality of Korean people’s lives has been increasingly improved in general due to the development of medical technology. The average life expectancy for males increased from 51.1 in the 1960s to 75.7 in 2006. The change in average life expectancy for females is even more startling, from 53.7 in the 1960s to 82.4 in 2006. In 2007, the crude birth rate was 10.1 and the crude death rate 5.0. Infant mortality is also decreasing gradually, from 61.0 per 1,000 live births in the 1960s to 5.3 per 1,000 in 2005. The total fertility rate is sharply decreasing, from 1.67 in 1985 to 1.13 in 2006.2. However, the increasing elderly population and decreasing birth rate are changing family structure in South Korea. The aging population is also becoming a social burden due to increasing medical expenses.

In South Korea, only authorized healthcare professionals can provide health services. The Medical Law stipulates that only doctors, dentists, nurses, oriental medical doctors, and midwives licensed by the Ministry of Health, Welfare and Family Affairs (MIHWAF) can provide health services. Nurse’s aides, acupuncturists, and massage therapists are described as quasi-medical professionals. As of 2007, there were 91,400 physicians, 23,114 dentists, 16,663 oriental medical doctors, 57,176 pharmacists, 8,587 midwives, and 235, 687 nurses in South Korea.

Korean patients can go to any doctor or any medical institution, including hospitals, which they choose. The referral arrangement system is divided into two steps. The patient can go to any medical practitioner office except specialized general hospitals. If the patient wants to go to a secondary hospital, he/she has to present a referral slip issued by the medical practitioner who diagnosed him/her first. There are some exceptions: in the case of childbirth, emergency medical care, dental care, rehabilitation, family medicine services, & hemophiliac disease, the patient can go to any hospital without a referral slip.

South Korea’s healthcare security system has three arms: the National Health Insurance Program, Medical Aid Program, and Long-term Care Insurance Program.

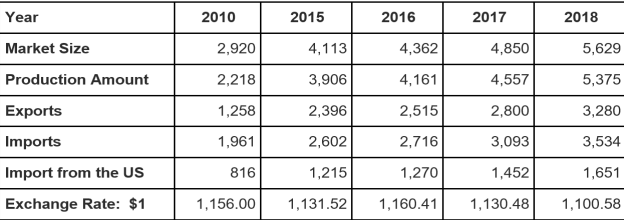

Medical Device Market Overview – By Year

According to the Ministry of Food and Drug Safety (MFDS), the market size for the medical device sector in South Korea has doubled since 2010. Ranked 9th in the world in 2018, Korea’s market reached approximately $6.2 billion in 2018 and imports from the U.S. increased from 0.9 billion in 2010 to $1.8 billion in 2018.

According to the Ministry of Food and Drug Safety (MFDS), the market size for the medical device sector in South Korea has doubled since 2010. Ranked 9th in the world in 2018, Korea’s market reached approximately $6.2 billion in 2018 and imports from the U.S. increased from 0.9 billion in 2010 to $1.8 billion in 2018.

To successfully identify business opportunities, it is essential to take a closer look into the unique aspects of Korea’s medical device market. The ratio of local production to imports has been steady at less than 40 percent over the past decade. In addition, nearly 80 percent of South Korean medical device manufacturers are small- and medium-sized enterprises (SMEs) with less than $1 million in revenue. South Korea’s medical devices are classified into the four categorical levels according to the product’s purpose and the degree of potential risk. As of 2018, over 65 percent of Korean medical device manufacturers are producing relatively low-risk medical devices (level 1 and 2).

In other words, South Korean companies make comparatively lower-end (mid-technology) medical devices. Therefore, market demand for high-end medical devices relies on imports. Among the list of importing countries in 2018, the U.S. consists of nearly half (47 percent) of total imports, followed by Germany (17 percent), and Japan (10 percent).

Medical Korea

Korea is emerging as a new leader on the global healthcare market through quality services, advanced medical technologies, relatively affordable medical costs, fast and efficient diagnostics and therapeutic services, cutting-edge hardware and IT-based infrastructure. Medical Korea stands for Smart Care and has been set up by the Korea Health Industry Development Institute (KHIDI), which works through conferences, exhibitions and other promotional activities to promote Korean healthcare facilities including traditional medicine for medical tourists.

Korea’s highly specialized doctors provide top-tier treatment for cancer, cardiovascular diseases, spinal disc injuries, organ transplantation, dentistry, cosmetic surgery, dermatology and more.

Korea is the leading country for clinical trial cases and ranks as Asia’s best in international medical journal publications. Data provided by the US government agency National Institutes of Health (NIH) reveals that while Korea ranked sixth globally,

Seoul was named the city with the most clinical trials last year.

Most Korean hospitals are non-profit organizations, putting patient safety and satisfaction ahead of profits.

The Korean government has strict regulation over hospitals to ensure optimum medical services. Patients opting for treatment in Korea can rest assured of receiving optimum medical care.

Moreover, the 11th Global Healthcare and Medical Tourism Conference started its online and offline events recently, organized by the Korea Health Industry Development Institution (KHIDI) and sponsored by the Ministry of Health and Welfare.

Shortened as Medical Korea 2021, the event presented academic conferences, briefing sessions, seminars, public relations events, and business conferences online while complying with the government’s quarantine measure.

Participants will discuss global healthcare development’s direction to recover from Covid-19 and return to a healthy daily life.

Medical Korea 2021 is one of the largest international events held by the Korean government to analyze global healthcare trends, discuss ways to attract international patients, and demonstrate the Korean healthcare sector’s excellence before global participants, officials said.

In this year’s event, major agenda items included global healthcare, academic exchanges between medical experts, and Korean medicine’s global competitiveness, accompanied by lectures from 52 Korean and foreign experts in healthcare and other related sectors.

In the session on the global competitiveness of Korean medical care, foreign patients and international experts introduced their experiences of receiving treatments and medical training, including their outstanding medical technology and safe medical system.

At the global healthcare section, participants presented the industry’s post-Covid-19 response strategy from policy, law, and marketing.

Eight briefing sessions provided the latest information on health care policies, systems and industry for domestic medical institutions, companies attracting foreign patients, and those wishing to expand the business overseas.