A new technique for treating patients with a common heart arrhythmia is rapidly replacing traditional methods in one of medtech’s biggest developments this year.

Atrial fibrillation (AFib), the heart rhythm disorder, affects 50 million people worldwide, yet less than 5% of those who could benefit from a cardiac ablation procedure to address it now get treated, according to Jasmina Brooks, president of Johnson & Johnson’s Biosense Webster subsidiary.

Heart device makers including J&J believe they have a solution to narrow that gap, a procedure called pulsed field ablation (PFA). The technology has sparked tremendous buzz among heart specialists and Wall Street analysts, who predict speedy adoption of the new technique.

“We believe that PFA will expand that market and hopefully help us improve that less than 5% number and improve the access for people who are impacted by AFib. That’s probably the biggest benefit that we expect from PFA,” Brooks said in a recent interview.

AFib causes the heart to beat inefficiently, increasing the risk of stroke or heart failure, and its prevalence is growing as the population ages. Drugs don’t always work to restore normal heart rhythm in AFib patients. PFA promises faster procedure times than traditional ablation methods and may be safer for patients.

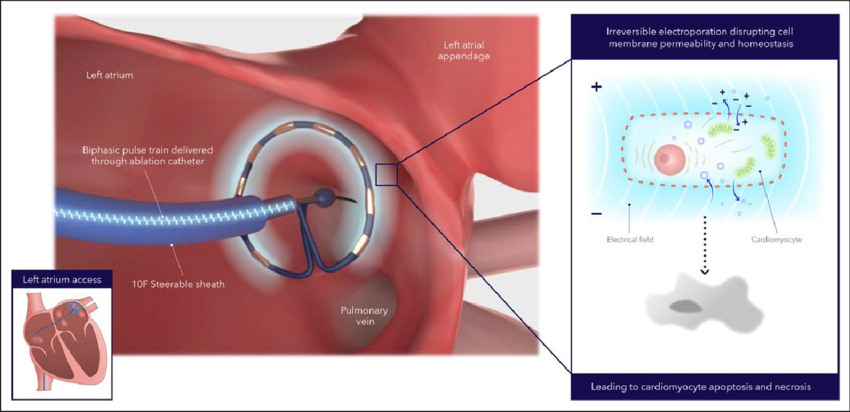

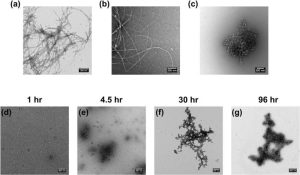

PFA applies nonthermal energy to correct faulty electrical signals in the heart. A catheter targets specific heart cells with high-voltage electrical pulses, reducing the risk of injury to surrounding tissue.

The technology differs from older techniques like radiofrequency ablation (RFA), which uses heat to scar heart tissue and block abnormal signals that cause AFib, and cryoablation, which uses extreme cold to target tissue.

“Physicians both in the U.S. and [outside the] U.S. are excited to try the innovation,” Brooks said. “They’re excited about the promise of safety, efficiency, workflow efficiencies as well. Those continue to be key considerations to adopting the new technology.”

The first PFA systems to hit the U.S. market — Boston Scientific’s Farapulse and Medtronic’s Pulseselect —started rolling out this year. Boston Scientific’s Advent pivotal trial was a tipping point for the industry, according to analysts, when the results last fall showed PFA to be as effective as RFA and cryoablation, and potentially safer.