Knight Frank underlines that the sector’s expansion is to be driven by consolidation, public private partnership opportunities, and introduction of highly specialized health services

Dubai is among the most, if not the most, rapidly evolving cities in the world, which embraces knowledge, technology and innovation with open arms. Dubai’s ambition of becoming the world’s smartest city by 2021 is case in point of this ambition and openness. The healthcare sector is one of corner stones for this rapid change, as it is ticks all the boxes relating to adoption and utilization of innovation, knowledge and technology.

Dubai is among the most, if not the most, rapidly evolving cities in the world, which embraces knowledge, technology and innovation with open arms. Dubai’s ambition of becoming the world’s smartest city by 2021 is case in point of this ambition and openness. The healthcare sector is one of corner stones for this rapid change, as it is ticks all the boxes relating to adoption and utilization of innovation, knowledge and technology.

Due credit must be given to the Dubai Health Authority (DHA) and other government bodies who have led this positive transformation and are tirelessly working towards improving this sector and turning the emirate into the medical hub of the region. Shehzad Jamal who is a Partner at Knight Frank and heading the Healthcare & Education Service Lines shares his expertise on the health care sector in the Emirate of Dubai in conversation with Vasujit Kalia.

Due credit must be given to the Dubai Health Authority (DHA) and other government bodies who have led this positive transformation and are tirelessly working towards improving this sector and turning the emirate into the medical hub of the region. Shehzad Jamal who is a Partner at Knight Frank and heading the Healthcare & Education Service Lines shares his expertise on the health care sector in the Emirate of Dubai in conversation with Vasujit Kalia.

Some of the recent trends and initiatives that continue to drive growth for the healthcare sector are listed below:

Government-led initiatives

- 10 year residency visa for specialists in medical, scientific, research and technical fields

- Permitting 100 per cent foreign ownership of businesses both onshore and offshore

- Promotion of medical tourism – Dubai has introduced a one stop shop portal in the form of Dubai Health Experience (DXH) which provides all relevant information such as; insurance, appointments, booking hotels and tickets etc. to help patients throughout the process

- DHA leading from the front by introducing telehealth across all DHA hospitals and health centers:

- Telemedicine for diabetic eye care

- Telehealth is being used to refer complicated cases to Rashid Hospital

- Robodocs are used linked to Rashid Hospital’s Trauma Center

- Mandatory insurance for all residents which also includes bold initiatives such as:

- Basmah initiative – scheme covers screening as well as treatment of three types of cancer; breast, colorectal and cervical

- Free screening and treatment of Hepatitis C patients

- Healthcare free zones: Dubai has introduced two healthcare free zones – Dubai Healthcare City (established in 2002, the first of its kind in the region) and Dubai Biotechnology and Research Park (under development)

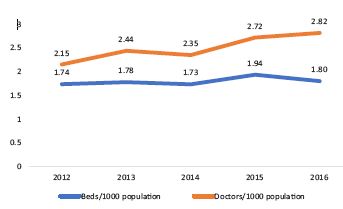

- Facilitating private sector participation has led to increased investment which is reflected in increasing beds and healthcare professionals per 1,000 population. [See Chart C]

Due credit must be given to the Dubai Health Authority (DHA) and other government bodies who have led this positive transformation and are tirelessly working towards improving this sector and turning the emirate into the medical hub of the region

| 2012 | 2013 | 2014 | 2015 | 2016 | |

| Beds/1000 population | 1.74 | 1.78 | 1.73 | 1.94 | 1.80 |

| Doctors/1000 population | 2.15 | 2.44 | 2.35 | 2.72 | 2.8 |

| Nurses/1000 population | 4.75 | 5.31 | 5.07 | 6.18 | 6.43 |

| Nurses/ Doctors | 2.21 | 2.18 | 2.16 | 2.27 | 2.28 |

| Source: DHA,HAAD, MOH,WHO statistics | |||||

Demographic trends

Demographic trends

- Population growth: The UAE has witnessed growth of 4.74 per cent during years 2007 to 2017, whilst population of Dubai has increased at a CAGR of 4.25 per cent during the same period. In addition, composition of the UAE population is evolving:

- Increased life expectancy (currently 77.6 years compared to 68 years in 1980) – leading to additional requirement for geriatric and long-term care related services.

- Wider middle-aged population base – expatriates are choosing to reside in the country for longer durations, creating demand for specialized services such as endocrinology, cardio vascular, neurology specializations etc, due to lifestyle diseases, unhealthy habits which get augmented due to consumption of processed foods, sedentary life style etc.

The UAE has witnessed growth of 4.74 per cent during years 2007 to 2017, whilst population of Dubai has increased at a CAGR of 4.25 per cent during the same period. In addition, composition of the UAE population is evolving.

The UAE has witnessed growth of 4.74 per cent during years 2007 to 2017, whilst population of Dubai has increased at a CAGR of 4.25 per cent during the same period. In addition, composition of the UAE population is evolving.

Propensity to spend on health

UAE spend per capita towards healthcare is the second highest in the region and rests at US$1,667. This demonstrates that residents are keen to get themselves treated in the country instead of travelling abroad or back in their home countries.

Sector activity

The sector is increasingly witnessing consolidation (re-enforcing the hub and spoke model) and arrival of international brands:

- Sector consolidation: The UAE witnessed over a dozen healthcare related transactions since year 2014, the most active companies were NMC Health PLC and Mediclinic Group.

- The country has recently seen entry of established foreign operators from the UK, US and Singapore such as Cleveland Clinic (Mubadala), Kings College Hospital London (Al Tayer Group), Huston Methodist Hospital (Merass) and Parkway Hospital (UEMS Group) etc.

Keeping in view all the points discussed above, the outlook of Dubai’s health sector is positive and presents opportunities to both healthcare operators and investors. The key opportunity areas identified by Knight Frank are presented below:

The country has recently seen entry of established foreign operators from the UK, US and Singapore such as Cleveland Clinic (Mubadala), Kings College Hospital London (Al Tayer Group), Huston Methodist Hospital (Merass) and Parkway Hospital (UEMS Group)

Capacity gap

There are approximately 4,627 hospital beds in the emirate with the private sector contributing 52.6 per cent of the total beds (CAGR of 13.7 per cent from 2012 to 2016). The total bed density sits at 1.9 beds per population is shy of the world average of 2.7 beds. However, it may be argued that with a relatively young demographic profile and new technology employed within healthcare in Dubai, the requirement of beds is not as high.

Dubai is divided into a total of nine sectors with Sector 3 hosting approximately 3,200 of all hospital beds. With the continuous expansion of the city and other sectors being increasingly populated there is an evident opportunity for healthcare operators to consider introducing healthcare facilities in Sectors 1, 2 and 4, These sectors combined host approximately 1.4 million people with only 1,157 beds to serve this population.

Telemedicine

Telemedicine

DHA has introduced telemedicine in its network which encourages the private sector and international healthcare ser vice providers to introduce this technology and broaden their penetration in Dubai and the region. A few private sector participants have entered the arena and seem to have gained traction with the local populous.

The potential in this area is immense and can pave the way for collaboration of domestic healthcare operators with other internationally renowned healthcare providers. The practical advantage of this method of care is that it provides immediate access to a healthcare professional, restricts travel to a healthcare service provider on a need basis and reduces the burden in the outpatient department of healthcare facilities. In critical cases, use of telehealth may also result in the saving of lives as real time specialist guidance can be provided in order to stabilize a patient in healthcare facilities which do not have adequate specialists.

Centers of Excellence

Centers of Excellence

Increasing general public awareness of healthcare shows an increasing inclination of the population seeking preventive care and for reactive measures they prefer centers of excellence over general hospitals.

This trend presents an opportunity for existing and new market participants to introduce:

- Windows for preventive care services such as screening programs, genetic studies to understand the disease predisposition among others, which has proven long term health and economic benefit for the patient and the overall health system of the country

- Centers of Excellence in areas of their core strength especially in medical conditions relating to oncology, orthopaedic and lifestyle related diseases.

- To summarize, Knight Frank believes that the healthcare sector will continue to witness growth on the back of strong market fundamentals and measures adopted by the government to make UAE and particularly Dubai a regional healthcare hub. Going forward the sector will continue to be driven by consolidation, public private partnership opportunities, interest of international operators and introduction of highly specialized health services.