With the future demand almost certain to grow, and the government’s

vision to increase private participation by 2030, healthcare could be one

of the most sought after industry.

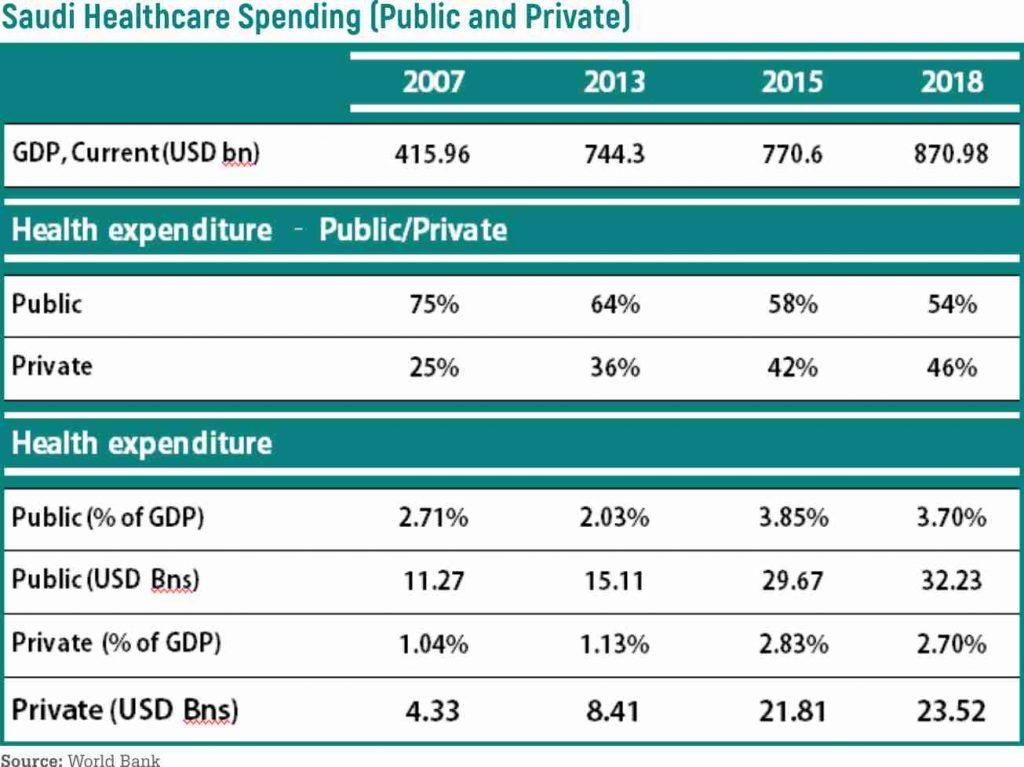

Healthcare services have always remained the priority sector of the kingdom of Saudi Arabia. The country offers free health facilities to its citizens’ womb to tomb. The government is benevolent to the extent that it has been paying for all medical charges liberally even outside the country if it is deemed as necessary for a patient to travel aboard to access advanced medical facilities. There are three service providers in the healthcare space in Saudi Arabia – Ministry of Health (MoH) hospitals, government hospitals and private players.

MoH runs over 60 per cent of the hospitals and primary healthcare clinics in Saudi Arabia while private players account for around a quarter of the health care infrastructure available in the country. The government has proposed to spend USD32.5 billion in 2017 for health and social development, which is 13.5 per cent of the total government budget. Well known is the fact that welfare expenses add to the already strained government coffers, hence, public expenditure in healthcare will be one area that the Saudi government would like to cut down.

According to Marmore’s report on Saudi Healthcare, the market share of Saudi Arabia in healthcare sector would be the highest in the GCC region with 54.4 per cent amounting to USD26 billion by 2020. Expectations for better facilities and quality healthcare is ever-increasing as patients who have travelled abroad for treatment expect similar standards in the home land as well.

Saudi Arabia has one of the fastest growing populations in GCC, indicating a spiralling future demand for healthcare facilities. Despite huge government spending, health care infrastructure in Saudi Arabia needs to be elevated to match international standards. In terms of efficiency of healthcare systems around the world (based on life expectancy, healthcare expenditure as a proportion of GDP, and healthcare costs per capita), Saudi Arabia is ranked 29th , lagging behind countries such as the U.S, United Kingdom and Singapore.

Facing challenges

The healthcare market faces alarming challenges such as dependence on imports of medicines and medical equipment, domination of expatriates in the workforce and business environment that is not conducive for the growth of private sector. Statistics would better indicate the reliance of healthcare facilities on imports.

Approximately 85 per cent of the drugs sold in KSA are imported mainly from Europe.Drug manufacturing in the country is very low owing to the lack of investments in R&D. The issue is compounded by an unpredictable Intellectual Property Rights (IPR) regulatory system. Pricing structure of these drugs are also vague apart from being highly controlled by the government due to which investors have an inhibition to enter the Saudi market.

The Saudi Arabian medical devices production sector remains in its nascent stages and imports accounted for 92 per cent of the market supplies (as of 2014). Domestic production is limited to low-end items such as bandages, furniture, medical disposables and surgical gloves. Restrictions on foreign ownership and entry barriers such as delays in obtaining permits and approvals and delay in payments to contractors in recent times have made investments in medical equipment manufacturing unattractive.

The healthcare market in the kingdom of Saudi Arabia is growth laden, nonetheless the path is equally confronted with bottlenecks. Adding to these issues, lower revenue from the hydrocarbons indicates that government spending on healthcare might take a hit in the future, a disquiet for people in the kingdom. However, every gloomy situation at the first sight is an upcoming growth opportunity after a deep thought. Saudi Arabia will have to confront these challenges and offer the best quality healthcare to its citizens.

Trust in market dynamics

How will the government do it, when it is struggling to revamp its economy from being oil dependent? Let the government just create and enable a well-regulated ecosystem, the rest will be taken care by the market dynamics. The government has decided that it will not pay for overseas treatment if the health authorities feel that similar facility can be offered within the country. Mandatory health insurance is also planned to be introduced by the end of 2017 for all Saudi employees and their family members working in the private sector while it is already available for expatriates and government employees. People covered with health insurance is expected to reach 6 million by the end of this year, increasing their ability to reach out to private healthcare for their ailments.

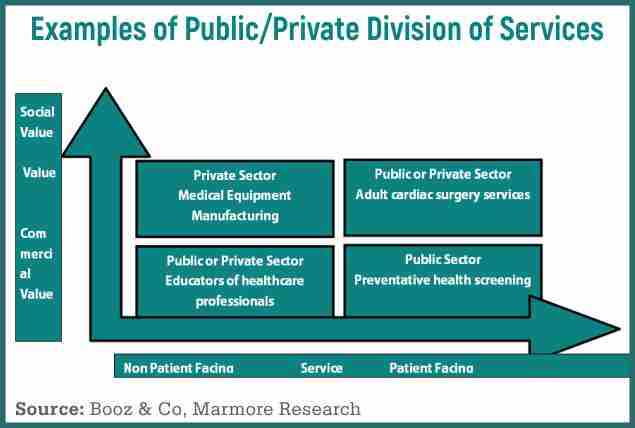

Firstly, private participation in healthcare services can help to bridge the gap. In terms of financial stimulus, the government can choose from multiple alternatives to offer incentives to private players. The government can guarantee the private sector to raise financing for projects. Public private partnership projects are expected to be the show starter for improving private participation in various sectors in the kingdom.

The government of Saudi Arabia has conducted studies in developed countries to understand the functioning of PPP projects and implement the same in KSA. Saudi Arabian government has planned to establish a unit under the Ministry of economy that would facilitate ‘Public Private Partnerships’ for execution of the stalled infrastructure projects. The unit is expected to conduct series of studies in developed countries to understand the working of PPP projects and devise a programme that would usher private sector to participate.

In addition, domestic players can be encouraged to partner with the government, especially in manufacturing of drugs and medicines. Encouraging them to manufacture generic drugs would bring down the cost of medicines in the kingdom. Certain segments such as the medical equipment manufacturing will require higher levels of skill with cutting edge technology asking for foreign investments. These are areas where the regulators need to encourage foreign players.

Saudi Arabia has already progressed in implementing some PPP health care projects. The Saudi Trans Sadara Company and China International Development and Investment Corporation Limited (CIDIC) is a joint venture to build four private hospitals in Dammam, Jubail, Riyadh, and Jizan, with a total project cost of USD 0.35 billion. The government has offered incentives by providing the land for construction of private hospitals. These hospitals are expected to be fully operational by the end of 2017 and expected to generate over 2,000 jobs for young Saudi nationals in the fields of nursing, procurement, marketing, administrative affairs, pharmacy, safety and security. Similar initiatives in the sector can come handy for the government to tackle the increasing demand for healthcare services in the country.

What the government needs to zero in on is framing regulations and for the private players to operate. The current regulatory framework is not conducive for free market dynamics and carries a lot of bureaucratic burden.

Creating a one-stop-shop

Healthcare sector in Saudi Arabia is regulated by multiple organizations such as the National Guard Health Affairs, Ministry of Defense, Ministry of Health, Ministry of Interior and Ministry of Education through university hospitals. The MoH plays the role of overall supervision in addition to follow up with healthcare related activities carried out by the private sector. Private players entering either drug or equipment manufacturing have an elaborate process to be completed with many supervisory organizations involved. Initiatives to create a one-stop shop for all approvals will make the process fast and efficient. It will also bring down the cost of compliance. Provision of mobile health, remote care delivery and application of medical coding standards needs attention in the kingdom. Private participation can also be channelled in technology driven health services in the country.

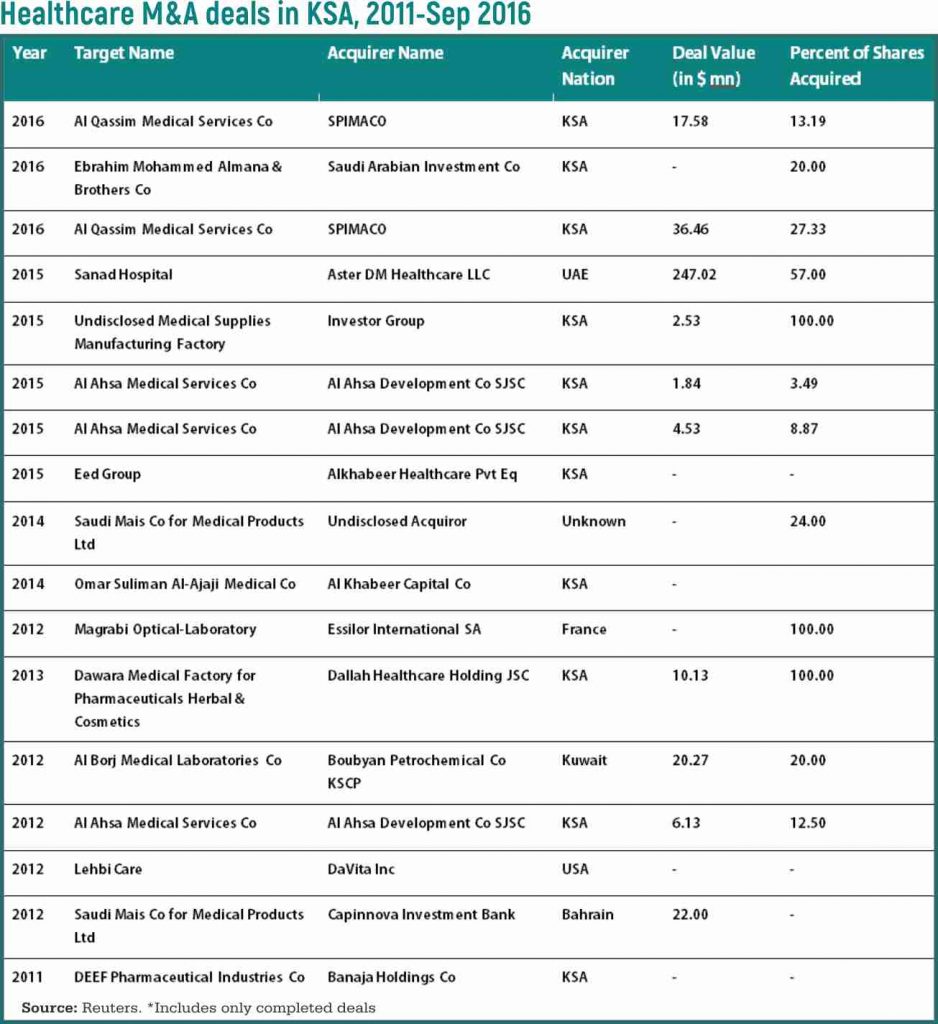

Fragmented nature of the healthcare industry, in terms of service providers, pharmaceuticals and insurance providers paves the way for consolidation, both within the business segment and across verticals. Healthcare has been the most active sector in Saudi Arabia in M&A in 2015 with deals worth USD 255.92 million completed. Aster DM healthcare acquired Sanad Hospital at a value of USD 247.02 million, the highest prized deal in the Saudi healthcare segment in the last five years. Sanad Hospital’s acquisition by Aster has helped to increase the capacity in terms of number of beds and quality by up gradation of the hospital facilities.

Very few vertical integrations have happened in the Saudi healthcare market, though it has been very popular in the developed world. In Saudi Arabia, organizations across the healthcare segment such as clinics, hospitals, equipment manufacturers, pharmaceuticals, IT service providers and insurance companies operate in silos. With the future demand almost certain to grow, and the government’s vision to increase private participation by 2030, healthcare could be one of the most sought after industry. Starting from increasing PPP projects and consolidation through mergers and acquisitions, it is quite possible that the healthcare market could witness a sea of changes in the coming years.

The current situation presents a need as well as an opportunity for the development of private healthcare in Saudi Arabia. The government’s recent policy changes clearly indicate an inclination towards privatization of healthcare services for both economic and quality reasons. Given the fact that the market is brimming with demand, international companies would be willing to start their businesses in the kingdom. Enabling the private players depends on the government’s endurance to create a hale and healthy Saudi Arabia.

Credits

MR Raghu is managing director of Marmore Mena Intelligence, a research house focused on conducting Mena-specific business, economic and capital market research. For your queries, pls email: research@e-marmore.com, or via twitter @marmoremena